Contents:

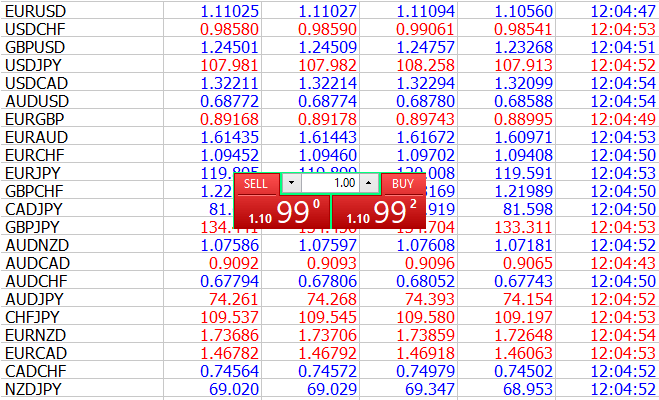

An indicator may flash a buy signal, but if the chart pattern shows a descending triangle with a series of declining peaks, it may be a false signal. Technical indicators represent some aspects of an asset’s trading data. They are generally based on mathematic formulas and they can represent anything from a stock’s price changes to its volatility, trading volume and much more. An oscillator is a technical indicator that swings between local minimums and maximums. Technical indicators refer to techniques used by entities during technical analysis to make investment decisions. It largely uses previous prices to forecast future price changes.

Dow Jones Technical Analysis: The Index is Receiving Some Support – DailyForex.com

Dow Jones Technical Analysis: The Index is Receiving Some Support.

Posted: Thu, 02 Mar 2023 23:39:27 GMT [source]

Besides providing valuable insight into the price structure, a technical indicator also shows how to reap potential profits from price movements. By analyzing historical data, technical analysts use indicators to predict future price movements. Examples of common technical indicators include the Relative Strength Index , Money Flow Index , stochastics, moving average convergence divergence , and Bollinger Bands®.

How to learn technical analysis?

First up, use theon-https://forexarena.net/ to measure the positive and negative flow ofvolumein a security over time. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. With technical analysis, you usually don’t know for sure whether it’s a true trend reversal or fake one until after the fact. On Balance Volume measures buying and selling pressure as a cumulative indicator that adds volume on up days and subtracts volume on down days. Chaikin Money Flow measures the volume-weighted average of accumulation and distribution over a specified period.

The result is a curve that tracks how the stock’s average price changes over time. The second is called “technical analysis.” With this approach, an investor reviews the stock itself. Together this data tells them how other investors on the market are trading this asset, which an investor can use to make predictions about how this stock will do in the future. In the technical investigation, a bogus sign alludes to a sign of future value developments that gives an off base image of the financial reality. Technical analysis tries to capture market psychology and sentiment by analyzing price trends and chart patterns for possible trading opportunities. Traders should be careful when taking trades solely based on indicators since they are not foolproof.

How to Find Momentum Stocks

A lagging indicator provides a historical report of conditions that led to the current rate. In comparison, a leading indicator is used to forecast where the price is going. Application of the technical indictors you select to use takes time and familiarity. It is always best to start off with just one or two indicators, preferably a price indicator and a momentum indicator.

Technical analysts analyze technical indicators independently to perceive possible changes in the behavior of each indicator. The structural changes within the various financial markets render the behavior of some technical indicators substantial. A technical indicator is generally a mathematically derived representation of data, such as price, volume, or open interest, to detect stock movement. The indicator is weighed based on historically-adjusted returns, common sense, an investor’s objective, and logic to evaluate investments and identify trading opportunities. Indicators are statistics used to measure current conditions as well as to forecast trends.

Simple Moving Averages – SMAs are the simplest type of moving average formed by computing the average price over a specific number of periods. Let’s take a look at different types of technical indicators, some of the most common indicators, and how to use them to increase your risk-adjusted returns. Quadency is a cryptocurrency portfolio management platform that aggregates digital asset exchanges into one easy-to-use interface for traders and investors of all skill levels. Users access simplified automated bot strategies and a 360 portfolio view with a free account.

What are the two basic types of technical indicators?

When these https://forexaggregator.com/ contract , this indicates high volatility; when these bands expand, this suggests low volatility may be present in an asset or stock market index. When plotting the PPO it starts with an initial value of 50%, then fluctuates above and below this level according to market volatility. Themoving average convergence divergence indicator helps traders see the trend direction, as well as the momentum of that trend. It is dangerous to trade an oscillator signal against the major trend of the market. In bull moves, it is best to look for buying opportunities through oversold signals, positive divergences, bullish moving average crossovers and bullish centerline crossovers. In bear moves, it is best to look for selling opportunities through overbought signals, negative divergences, bearish moving average crossovers and bearish centerline crossovers.

- For example, investors using fundamental analysis might use charts on a weekly or monthly scale, as more extended periods allow for more consolidation and trend periods.

- A good example of how the indicator works is to look at what happened during the Covid pandemic.

- The A/D line focuses only on the security’s closing price and trading range for the period.

A doji is a https://trading-market.org/ session where a security’s open and close prices are virtually equal. A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. These products are not suitable for all clients, therefore please ensure you fully understand the risks and seek independent advice. A leading indicator is more prone to giving false signals than a lagging indicator. When markets enjoy a sustained trend moving in one direction with minor corrections, you’d be looking to identify the direction of the trend and assess how long the move will last.

Support and resistance levels are another important concept of technical analysis. They are areas on a chart where the market’s price struggles to break through. Support levels are formed when a falling market reaches a certain level, and then bounces.

These technical indicators measure the strength of a trend based on volume of shares traded. These technical indicators measure the rate of price movement, regardless of direction. Photo by Chris Liverani on UnsplashEver wondered how to use technical indicators in trading? Well wonder no more, this article introduces 7 popular indicators, and the strategies you can use to profit from their signals. Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks. He was one of the first traders accepted into the Axi Select program which identifies highly talented traders and assists them with professional development.

Continuation patterns indicate that a market trend that was in place prior to the pattern formation will continue once the pattern is completed. Common continuation patterns are triangles , rectangles , flags, and pennants. Support is defined as a low price range in which the price stops declining because of buying activity.

By creating a time series of data points, a comparison can be made between present and past levels. For analysis purposes, technical indicators are usually shown in a graphical form above or below a security’s price chart. Once shown in graphical form, an indicator can then be compared with the corresponding price chart of the security.

That’s why you should lower the settings to get more accurate signals when trading on low timeframes. MACD is one of the most popular technical tools, as it provides numerous signals. They are signal and zero line crossovers, convergence/divergence, and overbought/oversold conditions. When implementing any indicator to the price chart, you can choose its parameters. We will start with one of the key technical tools that is not only widely used by traders but serves as a base for other indicators.

On-Balance Volume (OBV)

For RSI, anything below 30 and above 70 represents an extremity. For the Stochastic Oscillator, anything below 20 and above 80 represents an extremity. We know that when RSI is below 30 or the Stochastic Oscillator is below 20, an oversold condition exists. By that same token, when RSI is above 70 and the Stochastic Oscillator is above 80, an overbought condition exists.

Although it’s recommended to find confirmations from other technical tools, you shouldn’t combine too many indicators. This technical tool reflects the number of price changes within a certain period . The Volume Price Trend is mostly used on longer-term timeframes.

USD/JPY Technical Analysis: Attempts to Sell to Take Profits – DailyForex.com

USD/JPY Technical Analysis: Attempts to Sell to Take Profits.

Posted: Thu, 02 Mar 2023 10:43:31 GMT [source]

Gas prices have a tendency to rise as well whenever this happens. When the price of two commodities consistently move in opposite directions, they are negatively correlated. Two stocks moving independently of each other without any correlation can help with portfolio diversification. This is because when some shares in a portfolio are losing money, other non-correlated shares might still be gaining. Places dots on the price chart signaling support and direction when viewed consecutively.

Recente reacties