Content

She also wrote a syndicated column about millennials and money, and covered personal loans and consumer credit and debt. Amrita has a master’s degree in journalism from the University ofMissouri. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

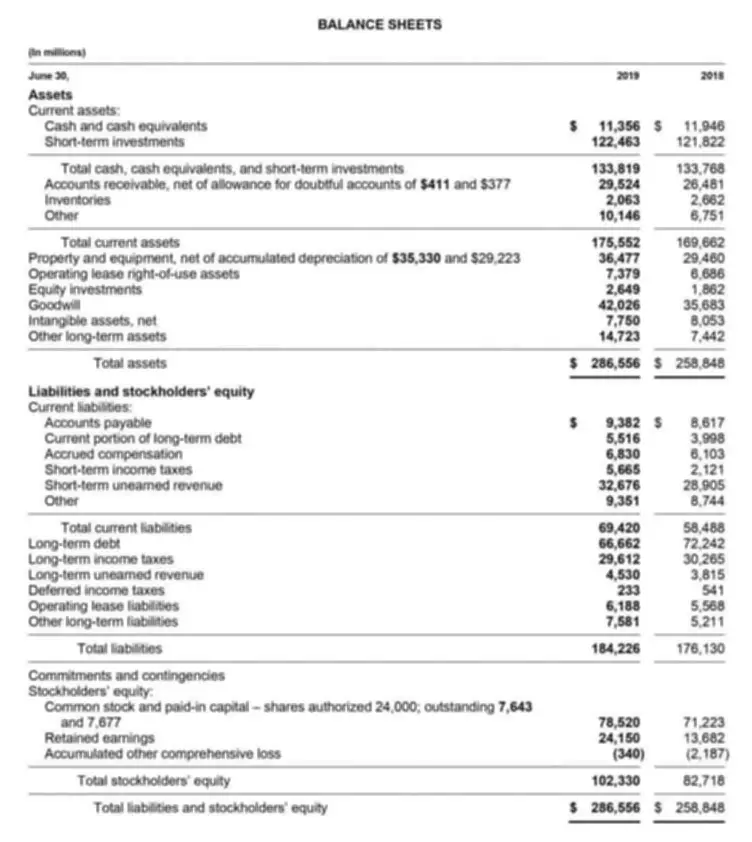

https://www.bookstime.com/ in a business firm is an important, but preliminary, function to the actual accounting function. Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process. Accountants, on the other hand, prepare the balance sheet and income statement using the ledgers and trial balance that the bookkeeper prepared. The balance sheet shows an entity’s financial status at a specific moment in time; usually at the end of a financial year. It may also cover just a three- or six-month period, i.e., a quarter or half-year.

Office management

A cash register is an electronic machine that is used to calculate and register transactions. The cashier collects the cash for a sale and returns a balance amount to the customer. Both the collected cash and balance returned are recorded in the register as single-entry cash accounts. Cash registers also store transaction receipts, so you can easily record them in your sales journal. In general however, the single-entry method is the foundation for cash-based bookkeeping.

What is bookkeeping?

It is the method of documenting the daily financial transactions of an organization. Ledger entries are made in the order of their occurrence. Additionally, bookkeepers reconcile bank records and report employers’ financial information in an organized format.

Furthermore, the number of transactions entered as the debits must be equivalent to that of the credits. For an accountant to be able to organise financial records properly and balance finances accurately, the information provided by the bookkeeper also needs to be correct. Otherwise, figures won’t be recorded right, meaning that records and updates will also be inaccurate. With double-entry bookkeeping, you create two accounting entries for each of your business transactions. Bookkeeping is the recording, on a day-to-day basis, of the financial transactions and information pertaining to a business. It ensures that records of the individual financial transactions are correct, up-to-date and comprehensive.

Kids Definition

what is bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as “real” bookkeeping, any process for recording financial transactions is a bookkeeping process.

Recente reacties