Contents:

View futures price movements and trading activity in a heatmap with streaming real-time quotes. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Any investment decision you make in your self-directed account is solely your responsibility. Get an overview of why a trade plan is important to thrive in futures trading and how to build one to support your success. RJO Futures is your one-stop brokerage for futures trading education.

- Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested.

- However, index futures are going to be less exposed to micro news events.

- Once you’re ready to enroll in seminars or classes, sticking with established, trustworthy institutions can help you avoid scams and incorrect or misleading information.

- Once you understand a behavior, how often it occurs, if it has potential, then you can start to figure out how to trade it.

The liquidity of a security is becomes very important as you trading size progresses. To calculate your profit or loss on a futures trade use the following formula. Market Ordersare used to instantly go long or short a security at the best price. With a market order, execution of the trade order is guaranteed but at what price is not. Ultimately, you’re borrowing the security from your broker to sell in the prediction that the price will go down at which point you can buy back the security at the cheaper price and return to your broker. Now that you are familiar with some of the different contract types, let’s take a look at the process of actually buying and selling futures.

Calculating Profit and Loss On Futures Trades

Hedgersuse the futures market to manage price risk of a given product. Want to learn how to trade futures and the basics of future contracts? Gain a better understanding of the world of futures trading, as well as its importance in the world of finance.

We really feel that with the ability to trade micro futures that the game of trading may someday change. Again, the great news is that your futures trading broker will handle everything for you automatically within your brokerage account. There are some very important stipulations to be aware of which we will teach and show you in our futures course. Each tick in the /ES is worth $12.50, so a 1 point move in the /ES is worth $50. If you have 1 contract and the futures moves up or down 1 point ($1) then you have the ability to make or lose $50 for each contract.

Are futures right for your trade plan?

To illustrate the real purpose of the futures market, consider the airline industry and the cost of jet fuel. Speculatorsare traders who accept the price risk in an attempt to profit from favorable price movement. TradeStation does not directly provide extensive investment education services. Options can serve as a protection for your investment in shares. In addition, several option strategies allow the investor to generate income when the market rises or when prices fall. Past performance of a security or strategy is no guarantee of future results or investing success.

Trading with the momentum transformer: an interpretable deep … – Risk.net

Trading with the momentum transformer: an interpretable deep ….

Posted: Wed, 22 Feb 2023 04:33:58 GMT [source]

Additionally some https://trading-market.org/ expire prior to the final settlement or expiration of the underlying futures contract. Option writing as an investment is absolutely inappropriate for anyone who does not fully understand the nature and extent of the risks involved and who cannot afford the possibility of a potentially unlimited loss. It is also possible in a market where prices are changing rapidly that an option writer may have no ability to control the extent of losses. It, thus, protects investors and traders from losing money on a transaction even if the price of the commodity or financial instrument rises or falls later.

The subsequent chapters discuss building trading systems using combinations of the ways one learned in the initial chapters. A fair amount of history lessons have also been provided regarding how one excavated the methods. Finally, it gives a detailed analysis to the reader about the various techniques and can convince them to adopt the practices because of the possible successes involved. The authors are real-life traders with many years of experience, giving an in-depth insight into the most common indicators and oscillators used in the market.

Futures

Hedge https://forexaggregator.com/A hedge fund is an aggressively invested portfolio made through pooling of various investors and institutional investor’s fund. It supports various assets providing high returns in exchange for higher risk through multiple risk management and hedging techniques. Easy to understand illustrations from a wide range of options trading strategies and explain its implications for each of them. OptionsOptions are financial contracts which allow the buyer a right, but not an obligation to execute the contract. The right is to buy or sell an asset on a specific date at a specific price which is predetermined at the contract date. Tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services.

References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. If you’re new to trading futures, don’t floor the accelerator.

In this beginner’s course, we go through the basics of options contracts, the differences between options and stocks, and we take a close look at risk in options trading. The main difference in approach between retail and professional day traders is that retail traders spend their time trying to guess what the market is going to do. Professional day traders trade what is happening right here, right now. If a market is moving up, a prop trader will buy it , when a typical retail trader sees a market moving up, they are looking for a chance to sell it. Not only does this mean they miss a lot of opportunities to join moves, it means they are always trading against the market. Another category of futures popular with investors is index futures, such as the e-mini S&P 500 indexfutures contract.

It gives https://forexarena.net/-life insights into the traders’ psychology and how it impacts the buyers and sellers. You’d think that any trading term that uses the word “volatile” would send you heading for the hills, portfolio in hand. Implied Volatility is just another useful tool in your options trading toolbox.

TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant. Get a look at Futures Trader— a professional-level futures trading tool on the thinkorswim® platform. Walk through some of its features, learn how to set up the display for futures trading, and explore how to place a trade.

Automated technical pattern recognition

If you are losing most of your trades, then you should consider dropping what you do now and using order flow on it’s own. That might sound scary but lots of traders end up spending 10,15,20 years trying various methods of chart reading and not getting anywhere. Prop traders don’t use order flow because it’s difficult but because they feel it’s the fastest and easiest path to profits for their trainees. Once you understand a behavior, how often it occurs, if it has potential, then you can start to figure out how to trade it. Our Futures course delivers this strategic edge by combining powerful skill-building lessons and hands-on live market trading classes. The trading resources and tools provided in the course are unique.

Futures trading strategies are a great way to grow both a small and large trading account. E-mini futures are the most popular to trade, however, micro futures are now a hot commodity in the market. Micro futures now afford traders the ability to trade with a small account, which has changed the game in the futures market.

- Take a deep dive into futures and arm yourself with indispensable knowledge that enables you to expand your strategy with confidence.

- Additionally, some larger brokers may also offer helpful training programs.

- Data contained herein from third party providers is obtained from what are considered reliable sources.

- This could seem like a logical way to try before you buy, but you could also be subjecting yourself to high-pressure sales tactics and ongoing phone calls to get you to try another seminar.

- Committing to an exit strategy in advance can help protect you from significant contrary moves.

- When volatility is low and prices are range bound, most day traders tend to get chopped up and find it difficult to make money.

Futures statements are generated both monthly and daily when there is activity in your account. They show key information like performance, money movements, and fees. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. Futures can fit into your overall trading strategy in several ways. For many investors, options may seem complicated or confusing.

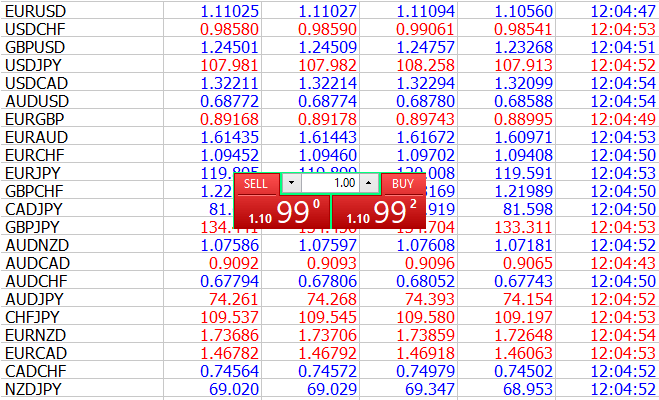

You’d have to go all the way back to 2002 to find data points representing the EUR/USD conversion rate that start with a zero to the left of the decimal point. A commodity is a physical product whose value is determined primarily by the forces of supply and demand. This includes grains (corn, wheat, etc.), energy , and precious metals like gold or silver, just to name a few. Chris Seabury has 20+ years of experience in the financial industry.